- #Paypal processing fees pdf#

- #Paypal processing fees verification#

- #Paypal processing fees code#

- #Paypal processing fees plus#

This fee will apply for requests of information relating to why we had reasonable justification to refuse your payment order. See Inactive PayPal Account Fee Table below. The inactivity fee will be the lesser of the fee listed below or the remaining balance in your account. To use Paypal Zettle, you need a Paypal account, which could be created for free. 1.This option isn’t something you can do if you run your business exclusively through PayPal and accept payments through an active website.

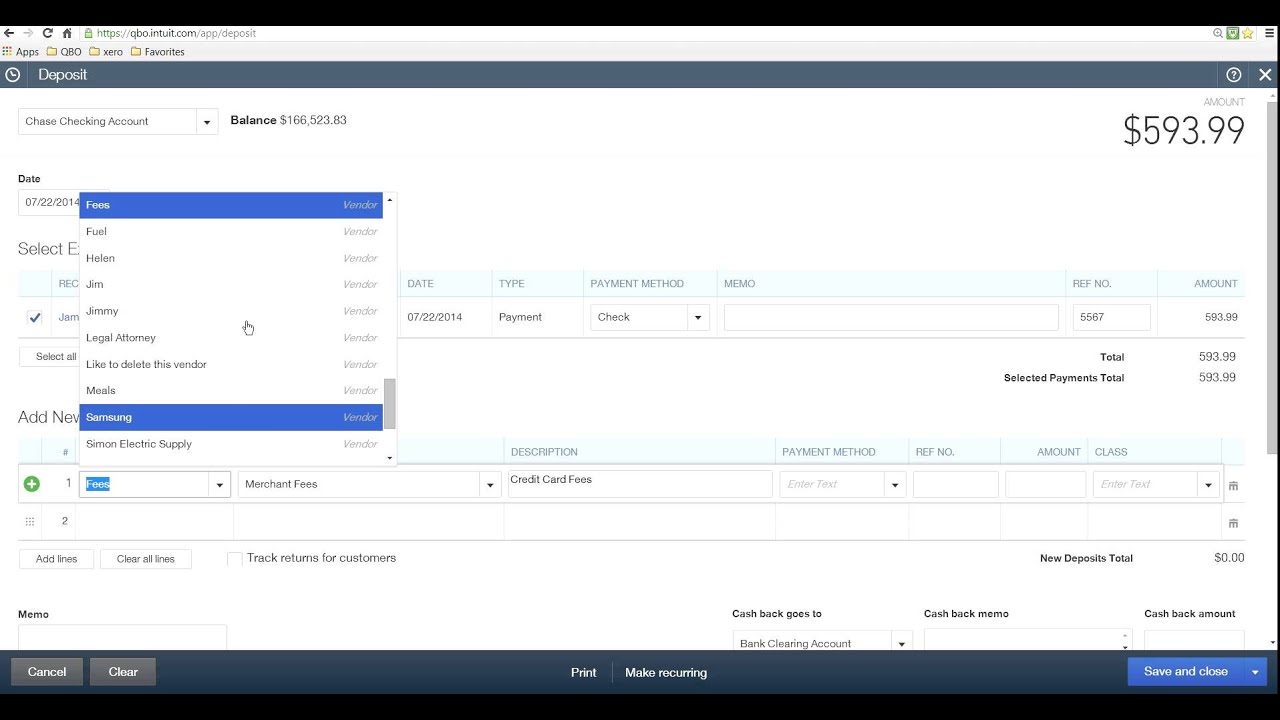

Processing fees: From 2.4 + 0¢ to 2.7 + 0¢, depending on your Shopify plan Paypal Zettle. See Credit Card and Debit Card Link and Confirmation Table below. Shopify Hardware Rental: You can rent hardware with fees as low as 9/day.

#Paypal processing fees verification#

This amount will be refunded when you successfully complete the credit card or debit card verification process. Some benefits of PayPal is their simple and fast account setup, integrations to.

#Paypal processing fees plus#

Some users, in order to increase their sending limit or as PayPal may determine, may be charged a credit card and debit card link and confirmation fee. In-store purchases will be 2.7 of every purchase plus a fixed fee of 0.30. The exact amount you pay depends on which PayPal product you use. See Bank Return on Withdrawal/Transfer out of PayPal Table below.Ĭredit Card and Debit Card Confirmation(s) PayPal’s payment processing rates range from 1.9 to 3.5 of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. This fee is charged when a Withdrawal/transfer out of PayPal is attempted by a user and it fails because incorrect bank account information or delivery information is provided.

#Paypal processing fees code#

For a complete listing of PayPal market codes, please access our Market Code Table.īank Return on Withdrawal/Transfer out of PayPal Market Code Table: We may refer to two-letter market codes throughout our fee pages. So, how does PayPal add up The costs look something like this: 2.75 for chip and pin/ contactless payments 5 plus 5 cents for a micropayment 2.9 plus a fixed fee to add PayPal buttons to your site 2.9 plus 30 cents for online sales 2.9 plus a fixed fee to add PayPal to your checkout 3. International transactions where both the sender and the receiver are registered with or identified by PayPal as resident in the United Kingdom, Guernsey, Jersey, Isle of Man are treated as domestic transactions for the purpose of applying fees. For a listing of our groupings, please access our Market/Region Grouping Table. Certain markets are grouped together when calculating international transaction rates. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page.

#Paypal processing fees pdf#

WePay has three distinct services: Link, Clear, and Core.Download printable PDF Last Updated: 19, December 2022 For starters, merchants integrate the payment system into their website to make the shopping experience seamless. WePay, which is a JPMorgan Chase company, is an online payment system that provides integrated payment solutions primarily to SaaS and crowdfunding platforms. Fees and restrictions vary between PayPal and WePay, making one more attractive than the other for some merchants.Paypal offers a variety of service options for merchants, for example, there are options for charitable organizations or businesses that require an integrated API.WePay offers three tiers of service-Link, Clear, and Core-which integrate into WePay's parent company, Chase.WePay is an online payment systems company that provides integrated payment solutions to crowdfunding and SaaS platforms.PayPal is an online payment systems company that facilitates money transfers and serves as an alternative to traditional paper payment methods.

0 kommentar(er)

0 kommentar(er)